Many folks step into the world of dental insurance with a rosy, albeit mistaken, belief: that their new plan is a magical key unlocking unlimited, fully-covered dental care. It’s a comforting thought, isn’t it? The idea that no matter the procedure, from a simple cleaning to a complex root canal, your insurance card will simply take care of it. Unfortunately, this vision is more of a dental daydream than a reality. The truth is, “all dental insurance plans cover everything” is one of the biggest misconceptions floating around.

Navigating the ins and outs of dental coverage can feel like learning a new language, filled with terms like deductibles, co-insurance, and annual maximums. It’s no wonder a simple, all-encompassing belief is so appealing. But understanding what your dental plan actually covers, and perhaps more importantly, what it doesn’t, is crucial for managing your oral health and your budget effectively. Let’s pull back the curtain on this common myth and explore the real landscape of dental insurance.

The Persistence of a Costly Misunderstanding

So, why does this idea that dental insurance is an all-access pass to dental services stick around so stubbornly? Several factors contribute. For one, the term “insurance” itself often carries connotations of comprehensive protection, similar to what people might expect (sometimes erroneously) from certain types of medical insurance. When we hear “insurance,” we think “covered.”

Marketing can also play a role. Advertisements for dental plans understandably highlight the benefits – “coverage for check-ups,” “discounts on procedures” – but may not always emphasize the limitations in bold print. It’s easy to catch the highlights and miss the fine print. Moreover, there’s a natural human tendency towards wishful thinking. Dental work can be expensive, and the idea of a plan that removes all financial barriers is incredibly attractive. We want it to be true, so the myth finds fertile ground.

Unpacking Your Dental Plan: What to Expect

Instead of thinking of dental insurance as a “cover-all” shield, it’s more accurate to view it as a benefit plan or a cost-sharing program designed to help reduce your out-of-pocket expenses for certain dental services. It’s a partner in your dental care, not a sole provider of funds. Most plans operate on a few key principles that are far from “covering everything.”

The Annual Maximum: Your Plan’s Yearly Cap

This is a big one. Most dental insurance plans come with an annual maximum. This is the absolute highest amount your insurance company will pay out for your dental care within a plan year (usually 12 months). These maximums often range from $1,000 to $2,500, though some can be lower or slightly higher. Once you’ve hit this limit, any further dental expenses for that year are typically 100% your responsibility, regardless of what the procedure is. Imagine needing a crown late in the year after already having a few fillings; if your maximum is depleted, that crown cost is all on you.

The Deductible: Your Initial Out-of-Pocket

Before your insurance even starts to contribute for many services, you’ll likely need to pay a deductible. This is a fixed amount you pay out-of-pocket each year. For example, if your deductible is $50, you’ll pay the first $50 of covered service costs. Some plans have individual deductibles and family deductibles. Often, preventive services like cleanings and exams are exempt from the deductible, which is a nice perk, but for restorative work, expect to satisfy this first.

Co-insurance: Sharing the Cost

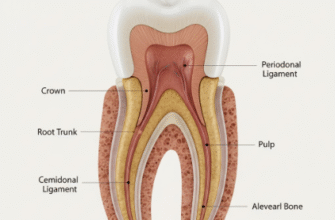

Once your deductible is met, your insurance doesn’t usually pay 100% of the remaining bill for most procedures. Instead, you’ll encounter co-insurance. This means you pay a percentage of the cost, and the insurance company pays the rest. A common co-insurance structure is the “100-80-50” rule, though this varies widely:

- Preventive Care (cleanings, exams, routine X-rays): Often covered at 80-100%. Your plan wants you to get these services to prevent bigger problems.

- Basic Care (fillings, simple extractions, sometimes root canals): May be covered at 70-80%.

- Major Care (crowns, bridges, dentures, surgical extractions): Often covered at a lower percentage, typically 50%, if covered at all.

So, if a crown costs $1,200 and your plan covers major services at 50% after your deductible, you’d still be responsible for $600, plus any remaining deductible amount.

Waiting Periods: Patience Required

Many dental plans impose waiting periods for certain types of procedures, particularly basic and major services. This means you must be enrolled in the plan for a specific length of time (e.g., 6 months for basic care, 12 months for major care) before those services become eligible for coverage. This is to prevent individuals from signing up for a plan only when they know they need expensive work immediately and then dropping it afterward.

Important Note: Always check for waiting periods before scheduling significant dental work. Assuming coverage is immediate for all procedures can lead to unexpected and substantial out-of-pocket costs. This is a common pitfall for new plan members.

What’s Often Not Covered (or Limited):

The idea of “everything” being covered truly falls apart when you look at common exclusions and limitations:

- Cosmetic Dentistry: Procedures like teeth whitening, veneers, and cosmetic bonding are almost universally excluded as they are not considered medically necessary.

- Orthodontics (Braces): If covered at all, orthodontia often has a separate lifetime maximum, which is usually lower than what comprehensive treatment costs. Some plans don’t cover adult orthodontics.

- Dental Implants: Coverage for implants varies significantly. Some plans offer no coverage, some offer partial coverage (often treating it like a bridge or denture), and a few might offer more substantial benefits, but rarely 100%.

- Pre-existing Conditions: Some plans might not cover conditions that existed before you enrolled, such as replacing a tooth that was missing prior to your coverage start date.

- Upgraded Materials: Your plan might cover a standard amalgam (silver) filling but not fully cover the cost of a tooth-colored composite filling, especially on a back tooth. You’d pay the difference.

- Frequency Limitations: Cleanings might be covered twice a year, X-rays once a year, and fluoride treatments only up to a certain age. Trying to get these services more frequently means you’ll likely pay out of pocket.

In-Network vs. Out-of-Network: The Provider Puzzle

The type of dental plan you have also dictates your choice of dentists and how much you’ll pay. PPO (Preferred Provider Organization) plans give you a network of “preferred” dentists. You can usually see dentists outside this network, but your out-of-pocket costs will be higher, and the plan might pay a smaller percentage. HMO (Health Maintenance Organization) or DMO (Dental Maintenance Organization) plans typically require you to choose a primary care dentist from within their limited network. You generally need referrals for specialists and receive no coverage for out-of-network care, except perhaps in emergencies. These plans often have lower premiums but offer less flexibility.

The LEAT Clause: Least Expensive Alternative Treatment

Watch out for the “Least Expensive Alternative Treatment” (LEAT) clause, sometimes called “Least Expensive Professionally Acceptable Treatment” (LEPAT). If there are multiple clinically acceptable ways to treat a dental problem, your insurance might only cover the cost equivalent to the least expensive option. For example, if you need a tooth restored, your dentist might recommend a crown, but if a large filling is also considered a professionally acceptable (though perhaps less ideal or durable) alternative, your insurance might only pay benefits based on the cost of the filling. You’d then be responsible for the difference if you choose the crown.

Decoding Your Coverage: Taking Control

Given that dental insurance isn’t a magical cure-all for dental costs, how can you avoid surprises and make the most of the benefits you do have? The key is to become an educated consumer of your own plan.

Read Your Policy Documents Thoroughly

This might sound tedious, but it’s the most crucial step. Your insurer provides a Summary of Benefits or a detailed policy booklet. This document is your roadmap. Look for key terms:

- Annual Maximum

- Deductible (individual and family)

- Co-insurance percentages for different categories of service (Preventive, Basic, Major)

- Waiting periods

- List of covered services

- List of exclusions and limitations

- Information on in-network versus out-of-network coverage

Don’t Be Afraid to Call Your Insurance Company

If the policy documents are confusing, or if you have questions about coverage for a specific procedure, call the customer service number on your insurance card. Prepare your questions beforehand. Ask about your remaining annual maximum, whether your deductible has been met, and the estimated coverage for the procedure code (your dentist’s office can provide this).

Communicate with Your Dentist’s Office

Your dentist’s administrative team deals with insurance companies daily. They are often very knowledgeable and can help you understand your benefits. They can also submit a pre-treatment estimate (or pre-determination of benefits) to your insurance company before you undergo any significant or costly procedures. This isn’t a guarantee of payment, but it gives you a much clearer idea of what your plan is likely to cover and what your out-of-pocket share will be. This helps avoid sticker shock after treatment.

Understand Your Explanation of Benefits (EOB)

After you receive dental care and a claim is processed, your insurance company will send you an Explanation of Benefits (EOB). This is NOT a bill. It details:

- The services performed and the date of service.

- The amount your dentist billed.

- The “approved” or “negotiated” fee (if your dentist is in-network).

- How much the insurance plan paid.

- Any amount applied to your deductible.

- Your co-insurance portion.

- The reason any services were not covered.

- The amount you are responsible for paying to the dentist.

Smart Ways to Approach Dental Expenses

While dental insurance is a helpful tool, it’s wise to have other strategies for managing dental costs, especially given its limitations.

Prioritize Preventive Care: The old adage “an ounce of prevention is worth a pound of cure” is exceptionally true in dentistry. Regular check-ups, cleanings, and good home hygiene can prevent many common dental problems from developing or catch them when they are smaller, less complex, and less expensive to treat. Since preventive care is often covered at a high percentage by dental plans, take full advantage of these benefits.

Discuss Treatment Options: If you need a significant procedure, talk openly with your dentist about all viable treatment options, their pros and cons, and their respective costs. Sometimes, a less expensive alternative might be suitable for your situation, or treatment can be phased to spread out costs and maximize insurance benefits over plan years.

Consider In-House Savings Plans: Some dental practices offer their own in-house dental savings plans or membership clubs. These are not insurance, but they typically involve paying an annual fee in exchange for discounted rates on services performed at that specific office. For individuals without traditional insurance or those whose insurance has high deductibles or low maximums, these can sometimes be a cost-effective option.

Look into HSAs and FSAs: If you have access to a Health Savings Account (HSA) or a Flexible Spending Account (FSA) through your employer or a high-deductible health plan, you can use these pre-tax dollars to pay for eligible out-of-pocket dental expenses, providing some tax savings.

The Reality: Dental Insurance is a Tool, Not a Total Solution

The myth that all dental insurance plans cover everything is, unfortunately, just that – a myth. Dental insurance is designed to assist with the costs of dental care, making it more accessible and affordable, but it rarely, if ever, eliminates those costs entirely. It comes with rules, limits, and exclusions that every plan holder needs to understand.

By moving past the misconception and embracing the reality, you empower yourself. Understanding your specific plan’s deductibles, co-insurance, annual maximums, waiting periods, and covered services allows you to plan better, budget more effectively, and make informed decisions about your dental health. Your dental insurance is a valuable partner in maintaining your smile, but you are the one in the driver’s seat when it comes to navigating its complexities. Stay informed, ask questions, and use your benefits wisely.