Ever heard someone say, “Oh, dental insurance? It’s all pretty much the same stuff, just pick one”? If you’ve nodded along, you’re not alone. It’s a common assumption, almost an urban legend in the world of benefits. But here’s the kicker: treating all dental insurance plans as identical is like saying all cars are the same just because they have four wheels and an engine. Sure, they share a basic purpose – helping manage dental costs – but the journey, the features, and the overall experience can be vastly different.

The truth is, the landscape of dental coverage is surprisingly diverse, filled with nuances that can significantly impact your out-of-pocket expenses, your choice of dentist, and the types of treatments you can access. Believing they’re all cut from the same cloth can lead to unexpected bills, frustration, and even delays in getting the care you need. So, let’s peel back the layers and expose why this myth is just that – a myth.

Why This Myth Persists

So, why do so many people believe dental plans are interchangeable? Part of it boils down to complexity. Insurance documents, with their jargon-filled pages of “deductibles,” “coinsurance,” and “annual maximums,” can feel overwhelming. It’s easier to assume they’re all variations on a theme than to dive into the nitty-gritty. Marketing, too, often focuses on the general benefit of “saving money on dental care,” glossing over the specific mechanics of how those savings are achieved.

Another reason is the “good enough” mentality. If someone has a plan through their employer, they might not shop around or compare, simply accepting what’s offered. Without that comparative lens, it’s easy to assume their plan is representative of all others. Plus, dental needs can be sporadic for some, so the intricacies of a plan might not become apparent until a major dental issue arises, by which time the “all plans are similar” belief has already taken root.

Unpacking the Differences: A Closer Look

When you actually start comparing dental plans, the differences jump out. It’s not just about the monthly premium; it’s about a whole host of factors that determine the plan’s true value for you.

Plan Types: Not a One-Size-Fits-All Structure

The most fundamental difference lies in the type of plan. Each structure operates differently, affecting cost, choice, and how you access care:

- DPPO (Dental Preferred Provider Organization): These are among the most common. DPPOs have a network of dentists who have agreed to provide services at negotiated, discounted rates. You generally have the freedom to see dentists outside the network, but your out-of-pocket costs will be higher. They offer a balance of flexibility and cost management.

- DHMO (Dental Health Maintenance Organization): DHMOs often have lower premiums. With these plans, you typically select a primary care dentist from a network. This dentist manages your care and provides referrals if you need to see a specialist (who must also be in the network). There’s usually no coverage for out-of-network care, except in emergencies. Copayments for services are common, rather than deductibles and coinsurance.

- Indemnity Plans (Traditional or Fee-for-Service): These plans offer the most freedom in choosing a dentist. The plan pays a percentage of what it considers the “usual, customary, and reasonable” (UCR) fee for a service, regardless of who provides it. You might have to pay the dentist upfront and then file a claim for reimbursement. Premiums can be higher, and you’re responsible for any difference between the dentist’s charge and the plan’s UCR allowance.

- Discount or Referral Plans: Technically, these aren’t insurance, but they’re often marketed alongside dental plans. You pay an annual fee and get access to a network of dentists who offer services at a discounted rate. The plan doesn’t pay anything towards your care; it simply provides access to lower pre-negotiated fees. There are no claim forms, deductibles, or annual maximums because it’s not an insurance product.

Clearly, choosing a DHMO expecting the flexibility of a DPPO, or vice-versa, will lead to a very different experience.

The “100-80-50” Illusion: Coverage Tiers Aren’t Standardized

Many people are familiar with the “100-80-50” rule of thumb: 100% coverage for preventive care (cleanings, exams), 80% for basic care (fillings, simple extractions), and 50% for major care (crowns, bridges, root canals). While this structure is a common framework, especially for PPO plans, the reality is far more varied.

- What’s “Preventive”? One plan might cover fluoride treatments for adults, another only for children. Bite-wing X-rays might be covered twice a year by one plan, but only once by another.

- Defining “Basic” vs. “Major”: The classification of services can differ. Is a root canal basic or major? Is a complex extraction basic or does it fall under oral surgery (often major)? These distinctions directly impact your coinsurance.

- Actual Percentages: The 100-80-50 percentages are not set in stone. Some plans might offer 90% for preventive, 70% for basic, and 40% for major. Or they might have different tiers altogether. Some budget plans might only offer good preventive coverage and very limited benefits for anything else.

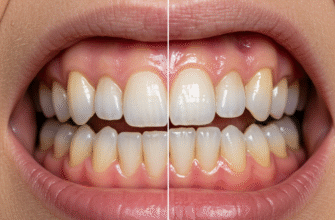

- Orthodontics & Cosmetic Dentistry: Orthodontic coverage is a whole different ballgame – if it’s offered at all, it often has a separate lifetime maximum and might only cover a percentage (e.g., 50%) up to that maximum. Purely cosmetic procedures like teeth whitening are very rarely covered by any standard dental insurance.

Network Nuances: Size and Accessibility Matter

If your plan (like a PPO or DHMO) uses a network, the size and quality of that network are crucial. A plan might boast a huge national network, but if there are few participating dentists in your specific geographic area, or if your preferred dentist isn’t included, its value to you diminishes. Going out-of-network with a PPO plan always means higher costs and potentially more paperwork. With a DHMO, going out-of-network typically means no coverage at all, barring emergencies.

Verified Tip: Before enrolling in any network-based dental plan, always use the insurer’s online provider directory to check if your current dentist participates. If you don’t have a regular dentist, see who is available in your local area. Don’t just rely on a general statement about network size; verify accessibility for your specific needs.

The Real Cost Breakdown: Beyond the Premium

The monthly premium is just the tip of the iceberg. Several other cost factors determine how much you’ll actually pay for dental care:

- Deductible: This is the amount you must pay out-of-pocket for covered services before your insurance starts paying its share. Deductibles can be per person or per family, and some plans waive the deductible for preventive services. A lower premium plan might have a higher deductible.

- Coinsurance: After you’ve met your deductible, coinsurance is the percentage of the cost you still pay for a covered service. If your plan covers 80% for a filling, your coinsurance is 20%.

- Copayments: More common with DHMOs, a copayment is a fixed dollar amount you pay for a specific service (e.g., $25 for an exam, $50 for a filling).

- Annual Maximum: This is one of the most significant differentiators. It’s the absolute most your insurance plan will pay for your covered dental services in a plan year (usually 12 months). These can range from as low as $500-$750 to $2,000 or more. If you need extensive dental work, a low annual maximum can be quickly exhausted, leaving you to pay 100% of further costs.

- Lifetime Maximums: Often applicable to specific, high-cost treatments like orthodontics. Once you reach this limit, the plan will not pay any more for that type of service, ever.

A plan with a low premium, high deductible, and low annual maximum might look cheap initially but could be very costly if you need more than basic preventive care.

Waiting Games and Fine Print: Exclusions, Limitations, and Frequencies

The “gotchas” in dental insurance often hide in the details:

- Waiting Periods: Many plans impose waiting periods before they will cover certain services. For instance, you might have immediate coverage for preventive care, but have to wait 6 months for basic services and 12 months (or even longer) for major services or orthodontics. If you need a crown next month, a plan with a 12-month waiting period for major care won’t help.

- Exclusions: These are procedures or conditions the plan simply will not cover. Common exclusions include cosmetic procedures, treatment for injuries covered by workers’ compensation or auto insurance, or replacement of teeth missing before you enrolled in the plan (a “missing tooth clause”).

- Limitations: These are restrictions on coverage. For example, a plan might cover fillings but limit the type of material (e.g., amalgam but not composite for posterior teeth, or only cover composite up to the cost of amalgam). Replacement of crowns or bridges might only be covered if the existing one is a certain number of years old (e.g., 5-7 years).

- Frequency Limitations: Plans often limit how often you can receive certain services. Cleanings are typically covered twice a year (sometimes with a 6-month interval required), full mouth X-rays every 3-5 years, and bitewing X-rays once a year.

Making an Informed Choice: Navigating the Options

So, how do you cut through the noise and find a plan that genuinely suits your needs, rather than just grabbing the cheapest or most convenient option?

- Assess Your Needs: Consider your dental health history and anticipated needs. Are you generally healthy with just routine check-ups? Or do you have a history of needing fillings, crowns, or other significant work? Do you have children who might need braces?

- Compare, Compare, Compare: Don’t just look at premiums. Get detailed summaries of benefits for any plans you’re considering. Line up the deductibles, coinsurance levels, annual maximums, waiting periods, and key limitations side-by-side.

- Check Your Dentist: If you have a dentist you trust, find out which plans they accept and if they are in-network. This can be a major deciding factor.

- Read the Fine Print: Yes, it’s tedious, but the Certificate of Coverage or Summary Plan Description contains all the crucial details about what is and isn’t covered. Pay special attention to exclusions and limitations for services you think you might need.

- Consider Your Budget: Balance the monthly premium against potential out-of-pocket costs. A slightly higher premium for a plan with a lower deductible and higher annual maximum might be better value if you anticipate needing more than just preventive care.

The notion that all dental insurance plans are birds of a feather simply doesn’t hold water. They vary dramatically in structure, cost, coverage, and flexibility. By understanding these key differences, you can move beyond the myth and make a choice that truly supports your oral health and your budget. Don’t let the assumption of similarity lead you to a plan that doesn’t fit. A little research upfront can save a lot of headaches and dollars down the road.