Many folks breathe a sigh of relief when they secure dental coverage, thinking, “Great, I’m covered for anything that comes up!” It’s a comforting thought, this idea that your dental plan is a comprehensive shield against all potential oral health expenses. But here’s a dose of reality that might be a bit like biting into an ice cube unexpectedly: the term “comprehensive” when applied to dental insurance is often more of an optimistic aspiration than a concrete guarantee. The truth is, dental plans are intricate, and assuming everything is covered can lead to unwelcome surprises at the dentist’s billing counter.

The Alluring Illusion of “Comprehensive”

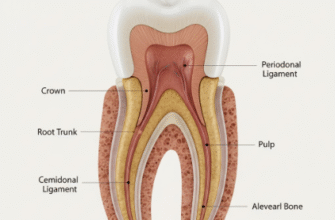

When we hear “comprehensive,” our minds often conjure images of an all-encompassing safety net. For car insurance, it might mean coverage for almost any mishap. For a university course, it suggests a deep dive into every facet of a subject. So, naturally, when “comprehensive dental coverage” is mentioned, it’s easy to assume it means your plan will pay for everything – from routine cleanings to complex root canals, shiny new crowns, and perhaps even those braces you’ve been considering. This is precisely the myth we need to bust.

In the world of dental insurance, “comprehensive” usually refers to the range of services that might receive some level of coverage, rather than full coverage for all services. A plan might cover preventive, basic, and major services, thus being “comprehensive” in its scope. However, this doesn’t mean it pays 100% for all these categories, nor does it mean there are no strings attached. Marketing materials can sometimes gloss over the finer details, highlighting the breadth of services potentially covered, while the nitty-gritty limitations are tucked away in the policy documents. It’s not necessarily deceitful, but it plays on our common understanding of the word “comprehensive.”

A Peek Behind the Curtain: Types of Dental Plans

Understanding that not all dental coverage is the same starts with recognizing that there isn’t just one type of dental plan. The landscape is varied, and each type comes with its own set of rules, network requirements, and coverage structures. None of them are inherently “fully comprehensive” in the way one might hope.

- Preferred Provider Organization (PPO) plans: These are quite common. PPOs have a network of dentists who have agreed to provide services at negotiated rates. You typically get better coverage if you stay in-network, but you often have the option to go out-of-network, albeit at a higher personal cost. Even in-network, coverage isn’t 100% for everything.

- Dental Health Maintenance Organization (DHMO) plans: DHMOs usually require you to choose a primary care dentist from their network. You’ll need referrals from this dentist for specialist care. These plans often have lower premiums and may feature no deductibles or annual maximums for certain services, but they are generally more restrictive in terms of provider choice and often use a copayment system for services rather than percentage-based coverage.

- Indemnity Plans (or Traditional Fee-for-Service): These plans offer the most flexibility in choosing a dentist. The plan pays a percentage of what they consider the “usual, customary, and reasonable” (UCR) fee for a service, and you pay the rest. These plans might have higher premiums and still feature deductibles and annual maximums.

- Dental Discount or Savings Plans: It’s crucial to note these are not insurance. You pay a membership fee and get access to a network of dentists who offer services at discounted rates. The plan pays nothing; you pay the full discounted bill. While helpful for saving money, they don’t offer the financial protection of an insurance policy.

Each of these structures has its own way of defining what’s covered and how much you’ll pay, underscoring that “comprehensive” is a highly relative term.

The Nitty-Gritty: Common Gaps in Coverage

This is where the “comprehensive” myth truly unravels. Even plans that cover a wide array of services usually come with specific limitations and exclusions. Ignoring these can lead to significant out-of-pocket expenses. Let’s explore some of the most common ones.

The Waiting Game: Waiting Periods

Imagine signing up for a new dental plan because you know you need a crown, only to find out you have to wait six months or even a year before the plan will contribute to that specific procedure. This is a waiting period. Many dental plans impose waiting periods for services beyond basic preventive care (like cleanings and x-rays). Basic restorative work (like fillings) might have a shorter wait, while major services (crowns, bridges, dentures, root canals) often have the longest. This is designed to prevent people from signing up only when they need expensive work and then dropping the plan.

Hitting the Ceiling: Annual Maximums

This is a big one. Most dental insurance plans have an annual maximum – the total amount the plan will pay for your dental care in a benefit year (usually a calendar year or a 12-month period from your enrollment). These maximums typically range from $1,000 to $2,500, though some can be higher or lower. Once your plan has paid out that maximum amount, you’re on your own for any further dental expenses for the rest of that benefit year, no matter how “comprehensive” the list of covered services might seem. If you need extensive dental work, it’s surprisingly easy to hit this cap.

How Often is Too Often?: Frequency Limitations

Dental plans often limit how frequently they will cover certain procedures. For example:

- Cleanings might be covered twice a year (sometimes with a strict six-month-plus-one-day interval).

- Bitewing X-rays might be covered once every 12 months, and a full mouth series (Panorex) only once every 3-5 years.

- Fluoride treatments might only be covered for children up to a certain age.

- Replacement of crowns or fillings might only be covered if the existing restoration is a certain number of years old.

The 100-80-50 Rule (And Its Variations)

Many dental PPO and indemnity plans use a tiered coverage structure, often referred to as the “100-80-50” rule, though the percentages can vary. This means:

- Preventive services (like exams, cleanings, routine x-rays) are often covered at 80-100%. Your deductible might be waived for these.

- Basic services (like fillings, simple extractions, sometimes root canals) are often covered at a lower percentage, perhaps 70-80%, after you’ve met your deductible.

- Major services (like crowns, bridges, dentures, implants if covered) are typically covered at the lowest percentage, often 50%, after your deductible.

Not Always Covered: Exclusions and Pre-existing Conditions

Every dental plan has a list of exclusions – services they simply won’t pay for. Common exclusions include:

- Cosmetic procedures: Teeth whitening, veneers purely for aesthetic reasons, and other cosmetic enhancements are almost universally excluded.

- Orthodontia: While some plans offer orthodontic coverage (often with a separate lifetime maximum), many do not, or it’s an optional rider you must purchase separately. Adult orthodontia is less commonly covered than for children.

- Experimental or investigational treatments.

- Services covered by workers’ compensation or other medical insurance.

It is absolutely crucial to understand that “covered service” does not equate to “free service” or even “fully paid service.” Many people get caught out by assuming their dental plan will absorb most of the cost for major procedures. Always verify your specific plan’s coverage details, including deductibles, coinsurance, and annual maximums, before committing to significant dental work to avoid unexpected financial burdens.

Becoming Your Own Dental Plan Detective

So, how do you navigate this complex landscape and avoid the pitfalls of the “comprehensive” myth? The key is to become an informed consumer. Don’t just rely on the glossy brochure or a quick summary.

Read your policy document: Yes, it can be dense and full of jargon, but the Summary of Benefits and Coverage (SBC) or the full policy booklet is your ultimate guide. This document outlines exactly what is and isn’t covered, the percentages, the limitations, and the exclusions. Pay special attention to:

- Deductible: The amount you have to pay out-of-pocket each year before your plan starts to share costs for services (preventive care is often exempt).

- Copayments (Copays): A fixed dollar amount you pay for certain services (more common in DHMOs).

- Coinsurance: The percentage of the cost you pay for covered services after meeting your deductible (e.g., if the plan covers 80%, your coinsurance is 20%).

- UCR (Usual, Customary, and Reasonable) Fees: If you have a PPO and go out-of-network, or an indemnity plan, the plan will pay a percentage of what *it* determines is the UCR fee for a service in your geographic area. If your dentist charges more than the UCR, you’ll pay the difference on top of your coinsurance.

- Annual Maximum and Lifetime Maximums: Note the annual cap and if there are any lifetime maximums, especially for things like orthodontia.

Ask questions – lots of them: Don’t hesitate to call your insurance provider if anything in your policy is unclear. Before undergoing any significant dental procedure, talk to your dentist’s office. They are usually adept at working with insurance. Ask them to submit a pre-treatment estimate (also called a pre-determination of benefits) to your insurance company. This will give you a clearer picture of what your plan is expected to cover and what your out-of-pocket costs will likely be. This single step can save a lot of headaches and financial stress down the line.

The myth that all dental coverage is comprehensive, covering everything under the sun without question, is just that – a myth. Dental insurance is a valuable tool for managing oral health costs, particularly for preventive and basic care. However, it’s a tool with specific instructions and limitations. By understanding that “comprehensive” refers more to the breadth of services that might receive some coverage, and by actively investigating the details of your specific plan, you can use your dental benefits wisely and avoid unwelcome financial surprises. Your smile, and your wallet, will thank you.